Structure of the forex market.

Tags:

In this lesson, we will learn how the forex market is structured and who is involved and their role. It will be helpful if you know where you are participating and with whom to join, right?

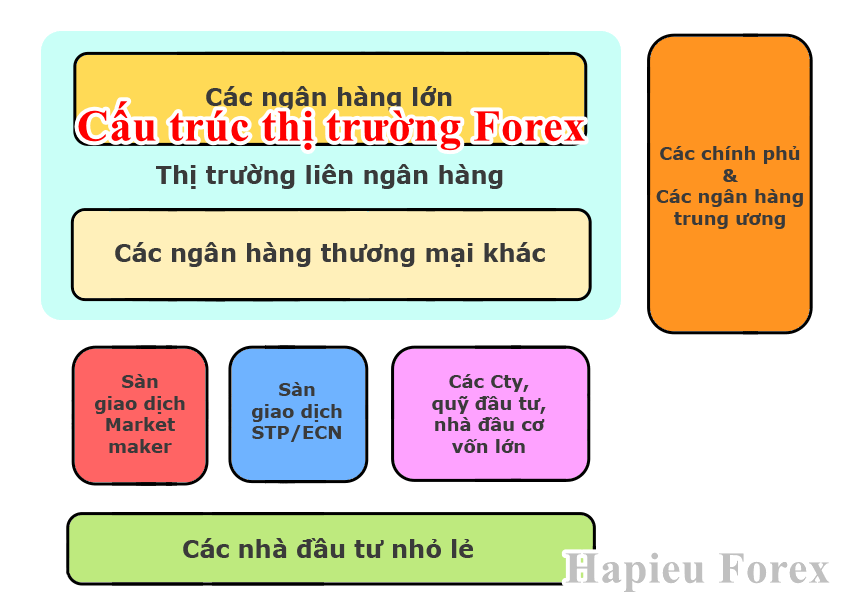

Forex market structure

Unlike the stock market, where there is a centralized trading center, the forex market does not have any centers. Instead, it has many transaction centers around the world such as in New York, Tokyo, Hong Kong, Sydney, Frankfurt and many other places. The structure of the forex market is described based on the classification of participants. The following is the hierarchy in the market:

On the top floor of the market are large banks and a number of commercial banks (about more than 1,000 members), forming an inter-bank market worldwide, where the exchange rate of foreign exchange assigned by the members. They exchange currency with each other based on their abilities and needs. To do that, members trade currencies directly or through one of two electronic systems called "Thomson Reuters Dealing 3000-Spot Matching" or "Electronic Brokering Services" (EBS), allowing any Every member knows how much money is in demand and the price that other members buy or sell. The exchange rate in the interbank market is the best exchange rate (or the original exchange rate) that usually only members have the privilege to enjoy.

Followed by those who have liquidity with the bank or can access the interbank market for their own purposes. This group often deals with large volume of banks (liquidity providers) in the interbank market. The composition of this group includes trading brokers bothMarketMakerandSTP, large companies, investment funds, asset managers, trading organizations and speculators. big capital.

At the bottom of the market are small investors (like you and me) dealing with brokers, and the brokers now act as liquidity providers in the small trading market. . In the past, it was difficult for an individual to trade forex because he had to call or sit directly on the floor to place orders, as well as need a huge amount of capital to trade. But today, thanks to the internet and the competition of exchanges, anyone can enter the market with very small amounts, about $ 100 or even smaller.

In addition to these components, governments and central banks (which often reflect government policies) also have an impact on the market by offering monetary policies and interest rates. productivity.

Who participates in the forex market?

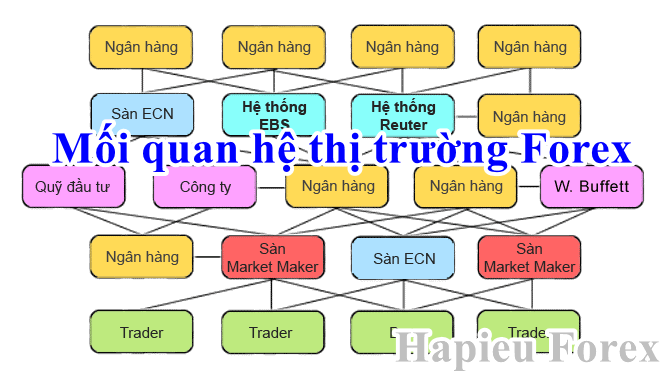

The relationship of the participants in the forex market can be described as follows:

Major banks and commercial banks

In the top tier of the market, big banks and commercial banks trade currencies together and so they are the ones who create and provide the exchange rate to the market. Major international banks in this group such as Deutsche Bank, Barclays, Bank of Switzerland, Citibank, Chase Manhattan, Standard Chartered, etc., all contribute to the impact on the currency exchange rate in the global market by trading commodities. billion dollars every day. The huge volume of transactions affected the exchange rate fluctuations of currencies.

Interbank transactions with the majority of trade revenue and speculative capital are carried out daily. A big bank can make billions of dollars in profits every day thanks to this activity. In addition to transactions with customers, most transactions are made at the bank's own account with priority processing department.

Only banks with credit relationships can make transactions. Big banks have more credit relationships, thus getting better exchange rates. Smaller banks without a lot of credit relationships will be less prioritized.

Governments and central banks

These are organizations responsible for controlling inflation and adjusting interest rates for currencies. They also play an important role in the forex market because they always try to control the money supply to achieve their economic goals. Central banks can stabilize and fluctuate their currencies in the forex market by changing interest rates, indirectly changing the currency exchange rate. By raising / lowering interest rates, they stimulate investors to buy / sell their currencies because of the high / lower profits and this makes the value of that currency increase / decrease. compared to other currencies.

The most influential banks in this group include: the Central Bank of the United States, the US Federal Reserve (FED), the European Central Bank (ECB), the German Central Bank (Bundesbank), the Bank Central England (BOE), Reserve Bank of Australia (RBA), Central Bank of Japan (BOJ) and People's Bank of China (PBoC).

Large commercial companies

Companies enter the forex trading market because they have a need for foreign currencies to pay for products and services in different countries. These companies often trade with a relatively small volume compared to other banks or speculative organizations, and its impact on the market is often small and short-term. However, the flow of international trade in general is still an important factor in the long-term impact on the currency exchange rate. Some multinational companies may have unforeseen effects on the market when a large volume of transactions and information are not disclosed.

Hedge funds and large speculators

A hedge fund is an investment fund that allows a wide range of investment and business sectors to be implemented, previously aimed at preventing risks for investors, but today most of these funds are still There are strategies for finding profits. Investment funds are limited in number of members and require a large amount of capital to be able to participate. Large capital speculators (also known as financiers) are individuals with huge capital to invest and do business, they can tend to "high risk - high profits" in the first missions. my private. (Ex: famous investors like George Soros or Warren Buffett).

With tremendous amounts, this group has some advantages that small investors cannot have such as trading with unlimited volumes, high financial leverage, better rates and news service. monopoly. In short, this is also one of the important members of the game.

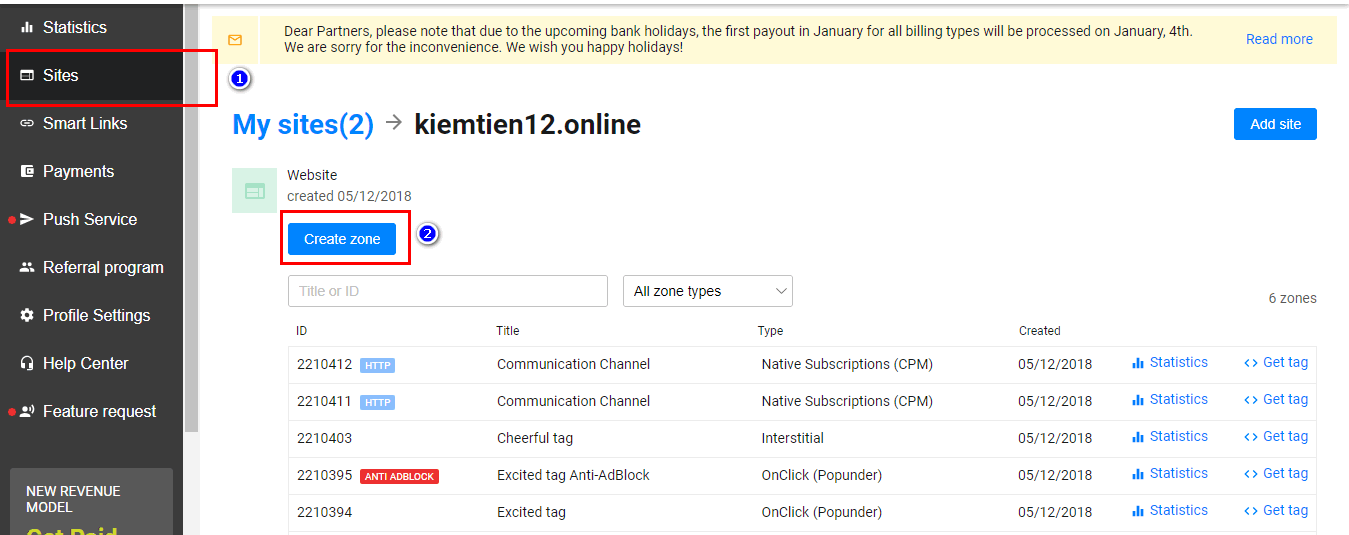

Trading brokers floors

Trading brokers floors are financial institutions that act as intermediaries to connect small traders (traders) to the forex market. The exchanges receive liquidity and exchange rates from banks or inter-bank networks, then supply them to traders. Depending on the trading model, the trading floor may have a profit from the exchange rate difference between the buying price and the selling price (for dealing desk model) or commissions for each transaction (for the model). no dealing desk brokers. In other words, they provide liquidity for the needs of buyers and sellers in the small trading market.

The trading floors collect money, the price difference or commission fee on customer transactions. That means whether your trading is profitable or loss, the trading floor still has a profit. However, small investors cannot join the forex market without these brokers, so it is important to select an appropriate trading floor.