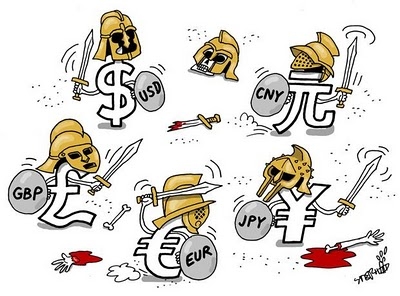

Forex market history

Tags:

People say that learning from the past is the best way to predict the future. Now, let's go back to the past a bit to learn the history of the word market

it was a stub until it was as complicated as it is today.

The origin of currency exchange

The concept of currency trading or exchange can be traced back to ancient times, when traders from different sectors had

demand for currency exchange when trading from one country to another. In ancient Egypt, the first coin was used, and then

Paper money appeared in the Babylonian times. The process of currency exchange continued until the Middle Ages and began to be maintained by interbank banks

Country, this is the first early form of the forex market. This has spurred the development of Europe and spread to the Central region

East. Therefore, it can be said that the forex market has the longest history compared to all other markets. It is also an advantage for the remaining markets.

Gold native system

The gold standard system is a financial system used in which transaction criteria are based on a fixed value of goods (here is Gold).

That means a certain amount of gold is assigned as a unit to exchange with other currencies. It started in 1816, when the Pound was

The rule is worth the equivalent of 123.27 grams of Gold. It also means that the value of British banks has been determined and vice versa it also helps the currency

The UK holds value in the market. The United States also adopted the gold standard system in 1879 and the US dollar replaced the British pound when the European countries

Europe stopped using the gold standard system because World War I broke out.

Bretton Woods system

When World War II ended, the status of the great powers changed. Britain must experience a financial bubble and heavy crisis, while water

America retained its status after the war. The US dollar was crowned and became the new standard in the financial market. Then at the conference

Bretton Woods, internationally has decided the value of currencies at fixed exchange rates for US dollars, taking the US dollar as the main reserve currency and it is copper

The only money is guaranteed in gold. This is called the Bretton Woods system.

Free exchange rate system

In the 1970s, a number of great powers, including Britain, went through many things; Financial scarf and began to float their coins.

The Smithsonian Agreement was signed in 1971 to create a more flexible agreement than the Bretton Woods agreement, whereby exchange rates could be more volatile.

before. The European market is also trying to find a way out of its dependence on the US dollar to ensure the flexibility of other currencies as more and more

many joint ventures and many business contracts were signed. After that, both the Smithsonian agreement and the European Union of Freedom were broken, signaling the main

mode switched to the free-rate floating system where the exchange rate for each currency was determined by the supply-demand relationship. At that time, governments could freely choose

choose to control, partially control or completely float your money. By 1978, the official release of money became compulsory.

Online trading - The great revolution of the foreign exchange market

In 1994, online currency trading began to launch, with the first foreign exchange (forex) transaction being conducted via the internet. This is only possible

become a reality when there is a combination of technical progress, telecommunications infrastructure and policy innovation. Since then, the forex market has grown to date

Now, with 5000 billion USD traded every day. The big change in the forex market is that anyone can now invest in this market.

Most participants in forex trading are mainly due to this market's over-investment opportunity.